In the 2000s the supply outlook for natural gas in the USA was transformed by the emerging viability of unconventional gas supplies, primarily shale gas. By 2009 the International Energy Agency (IEA) described unconventional gas as being 'unquestionably a game-changer in North America with potentially significant implications for the rest of the world'.

While shale gas has been extracted in North America since the early-to-mid nineteenth century, it has been dwarfed by conventional gas production for most of the intervening period. However, the high gas prices in the late 2000s and the application of new horizontal drilling and hydraulic fracturing ('fracking') techniques spurred some petroleum geologists in North America to re-examine the feasibility of exploiting reserves of unconventional gas by extracting shale gas from deep rock formations.

North American boom

The result has been the development of many commercially viable shale gas fields in the eastern and central United States and the ongoing rapid development of other shale gas plays throughout the USA and Canada. By the end of 2009, shale gas accounted for 21% of proved natural gas reserves in the USA. It had also contributed to a significant increase in proved US gas reserves (2009 proved reserves were 46% higher than 1999 reserves).

BP estimates that, together with coal bed methane, shale gas could make up about half of indigenous North American gas supplies by 2030. North America has set the pace in gas shales; now, Europe, Australia and China are seeking to identify and exploit opportunities, but the scale of the global resource is still unknown.

BP estimates that, together with coal bed methane, shale gas could make up about half of indigenous North American gas supplies by 2030. North America has set the pace in gas shales; now, Europe, Australia and China are seeking to identify and exploit opportunities, but the scale of the global resource is still unknown.

Europe

The nearest drilling programme to Ireland is underway in Lancashire, UK. This is exploring geological formations linked to the Morecombe Bay and other nearby offshore gas fields as prospects for the development of shale gas.

In its Energy Outlook 2030, BP noted that although the global scale of unconventional gas has yet to be properly appraised, it 'could add another 30 years of supply'.

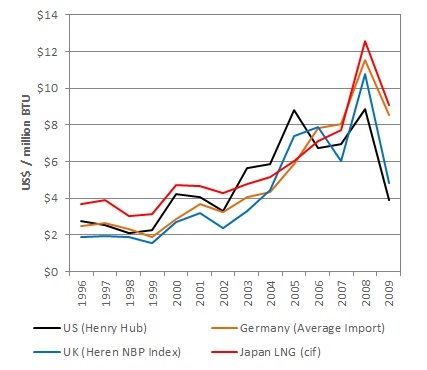

Already, there is a possibility that the success of shale gas in the USA could have ripple effects in other parts of the world, notably in Europe where gas prices have overtaken those in North America since the mid 2000s.

Natural gas prices 1996-2009

Liquefied natural gas (LNG)

Although LNG imports amounted to only about 2% of US consumption in 2009, until recently it had been assumed that more substantial LNG imports would be required to top up the insufficient supplies available from domestic sources and Canadian pipeline imports. The exploitation of massive quantities of shale gas has contributed to significant reductions in North American gas prices, reduced demand for LNG imports and, as a result, the prospect of additional LNG supplies available for European gas consumption.

According to the IEA, the expansion of North American shale gas production, together with the dampening of global demand through recession “is expected to prolong the glut of gas supply for the next few years” (November 2009). For Europe, this could mean additional LNG shipments – shipments that may have originally been destined for the US market.

Environmental concerns

Shale gas is not without its challenges. In particular, there are concerns regarding the potential contamination of aquifers and water courses as well as the release of methane to atmosphere, which has a high global warming potential and could have localised health & safety implications. The US EPA has initiated a comprehensive research study of the potentially adverse impacts of hydraulic fracturing and other aspects of shale gas projects (report due in 2012). The outcome from this study could affect both the future environmental regulatory framework and the extraction economics for shale gas.